Automate The General Trading Business Process

May 13, 2024

Streamlining Fertilizer Business Operations: The Role of Accounting Software

May 17, 2024

Simplify Your Service Business Operations

General service businesses provide services rather than products. Examples of general service businesses include consulting firms, marketing agencies, and IT support companies. These businesses require efficient financial accounting processes to ensure that they are profitable and financially stable.

In this blog, we will explore the business processes involved in general service businesses from a financial accounting point of view.

Record Keeping:

The first step in financial accounting for general service businesses is to keep accurate records of all financial transactions. This includes recording all income and expenses, as well as any assets and liabilities.

Budgeting:

Budgeting is a critical component of financial accounting for general service businesses. A budget helps to set financial goals and track progress towards those goals. It also helps to identify potential areas of improvement and cost-saving opportunities.

Invoicing:

Invoicing is a critical process for general service businesses. It involves creating and sending invoices to clients for services rendered. The invoicing process should be efficient and accurate, with clear and concise descriptions of the services provided and the associated costs.

Accounts Receivable Management:

Accounts receivable management involves monitoring and collecting payments from clients. This process is essential for maintaining a healthy cash flow and ensuring that the business has sufficient funds to operate. Proper accounts receivable management involves setting clear payment terms, following up with clients who are late on payments, and taking appropriate action to collect overdue payments.

Accounts Payable Management:

Accounts payable management involves managing the business’s debts and ensuring that all bills and expenses are paid on time. This includes monitoring and recording all invoices and expenses, negotiating payment terms with suppliers, and managing cash flow to ensure that there are sufficient funds to cover all expenses.

Financial Reporting:

Financial reporting involves preparing financial statements, including the income statement, balance sheet, and cash flow statement. These statements provide a clear picture of the financial health of the business and help to identify areas of strength and weakness.

Tax Compliance:

Tax compliance is a critical component of financial accounting for general service businesses. It involves ensuring that the business complies with all relevant tax laws and regulations. This includes filing tax returns, paying taxes on time, and maintaining accurate records of all tax-related transactions.

Conclusion

Efficient financial accounting processes are critical to the success of general service businesses. Proper record-keeping, budgeting, invoicing, accounts receivable management, accounts payable management, financial reporting, and tax compliance are all essential for ensuring that the business is profitable and financially stable. By implementing these processes, general service businesses can make informed decisions and achieve financial goals.

Recommendation

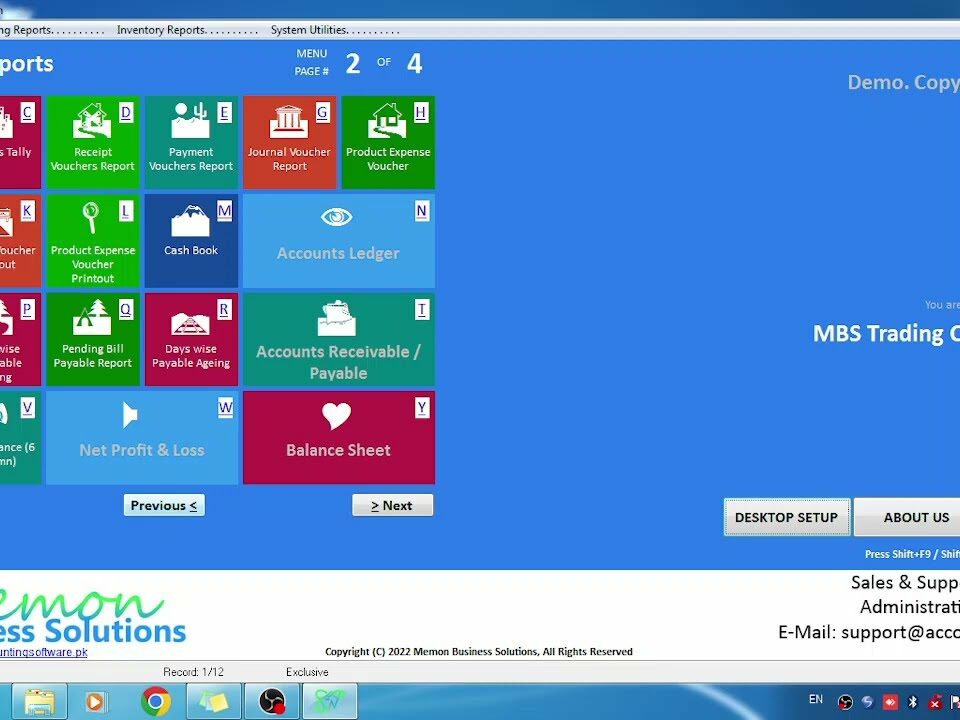

Are you tired of spending hours on accounting tasks for your general service business? Say hello to MBS Accounting Pro! Our user-friendly software automates your accounting processes, so you can focus on growing your business. With features like invoicing, accounts receivable and payable management, financial reporting, and tax compliance, you’ll have everything you need to manage your finances with ease. Plus, our software is customizable to meet the specific needs of your business. Say goodbye to the stress of financial accounting and hello to MBS Accounting Pro. Try it out today!

Alternative to MBS Accounting Pro for above Business are;